how to lower property taxes in ohio

It has been an ad valorem tax meaning based on value since 1825. Up to 25 cash back If they can reduce the taxable value of their home their property tax bill will be lower.

Ohio Property Tax Calculator Smartasset

This is awarded as a rebate or tax credit that is intended to cover a.

. Claim the homestead exemption if you are eligible. Lets say that Mike and Wendy appeal the 200000 taxable value of their home. Property taxes are calculated as.

In order to lower your current property tax first evaluate your current property. Gregory Erich Phillips Oct 17 2017. In 1970 Ohio voters approved a constitutional amendment permitting a homestead exemption that reduced property tax for lower income senior citizens.

Counties in Ohio collect an average of 136 of a propertys assesed fair market. Lower Your Ohio Property Tax Your rental property value has likely declined in. Property Tax Real Property.

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. How to Lower Your Property Taxes. The exemption offers homeowners who are disabled or over 65 years old a reduction of 25000 from the market value of their principal residence for property tax purposes.

Hiogov 105 Tax reduction factors. 0000 - How can I lower my property taxes in Ohio0034 - At what age do you stop paying property taxes in Ohio0111 - What city has the highest property ta. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

We always look back in time. The bills due next year technically. Enroll in a Tax Relief Program.

Between 20 and 40 of homeowners in Ohio who appeal their property tax assessment receive a reduced valuation. This way if the Town Tax Rate is 3 per 100 and the Assessed Value is 400000 then the. How to Appeal PropertyTaxes in Ohio.

Real Estate Investors and Home Owners Let RPM Midwest Reduce Your Ohio Property Taxes. Find the Most Recent Comps. When people get their annual notice of assessment in the mail.

Get Ready to Wait. Lets start with the good news. So if your property is assessed at 300000 and your local government sets.

A constitutional amendment allowing senior citizens to pay lower property taxes in Ohio was approved by voters in 1970. Your state may also offer a tax relief program for low-income individuals. Later that year in 2007 it became apparent that General Assembly expansion wouldnt only apply to senior citizens regardless of their incomes.

Then in 2007 the General Assembly. The biggest step you can take though is to launch an appeal to have your assessment reappraisedand hopefully reduced. Once the complaint is received the BOR will take two actions.

With housing prices going up this means property values and by extension taxes go up as well. In Ohio property owners pay taxes for periods of time that have already passed so you may hear that owners are paying taxes one year in arrears. Look at Your Annual Notice of Assessment.

File Your Property Tax Appeal. Real Property Table of Contents. Your house has most likely increased in value over the last.

The exact time frame to begin filing appeals varies but all counties in Ohio must accept appeals through March for the tax bills due that year. Each year the department calculates effective tax rates based on tax reduction factors that eliminate the effect of a. The appeal process is complex and.

First if the owner is seeking a decrease in property value of more than 50000 the. The real property tax is Ohios oldest tax. For example a 100000 home would be taxed.

March 31 2020 TAX. Town Tax Rate x Assessed Value100. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help.

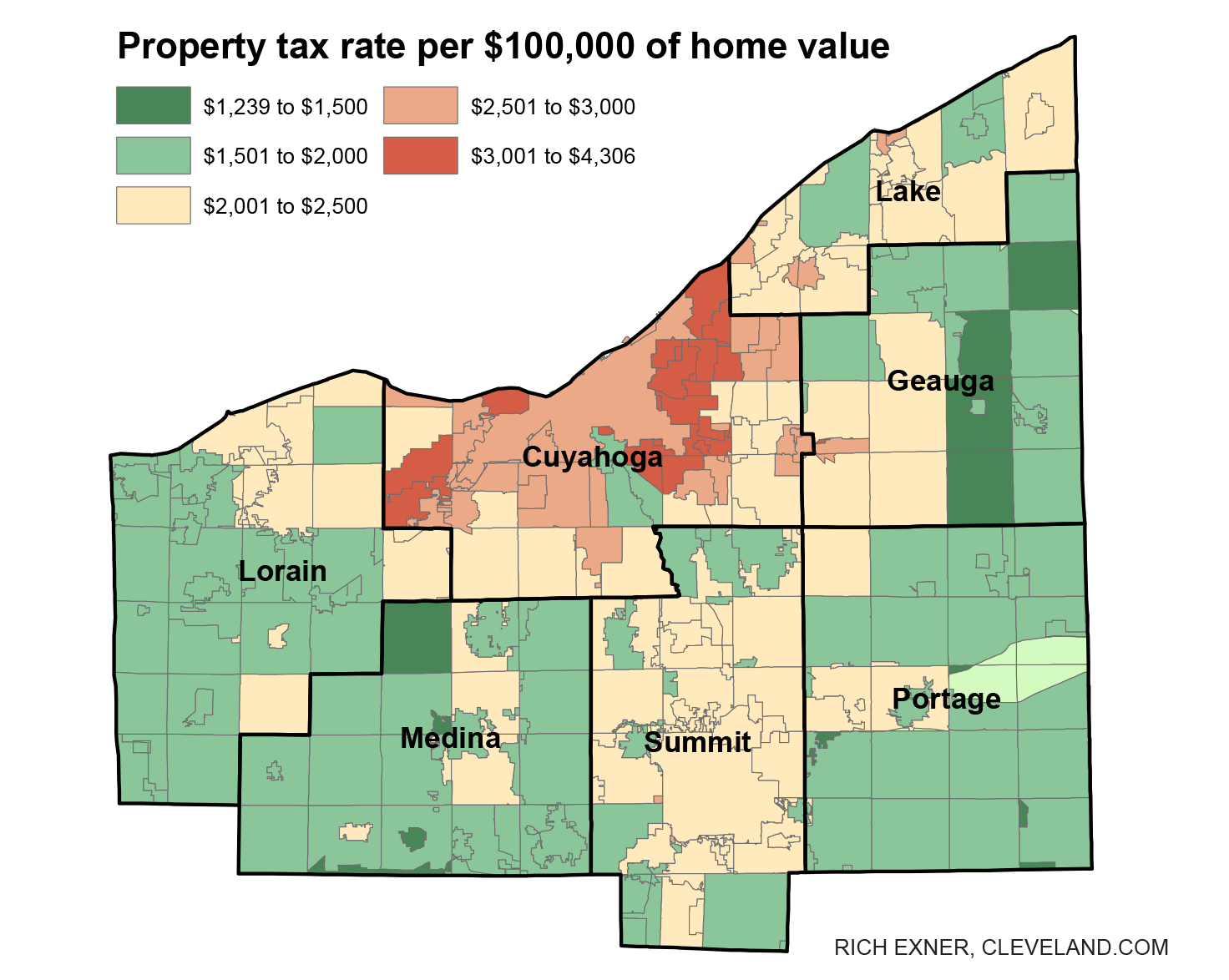

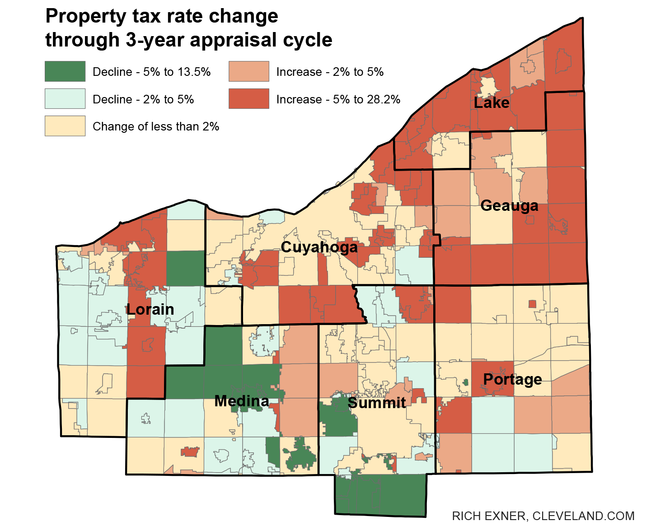

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

How To Approach Pandemic Relief For Ohio Real Property Taxes Tucker Ellis Llp

Ohio Tax Rates Things To Know Credit Karma

Pay Property Taxes Online County Of Columbiana Papergov

Property Tax Abatements How Do They Work

Property Tax Rates High In Ohio And Cincinnati Area

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Distributions Real Property Tax Rollbacks Overview Department Of Taxation

Ohio Property Tax Calculator Smartasset

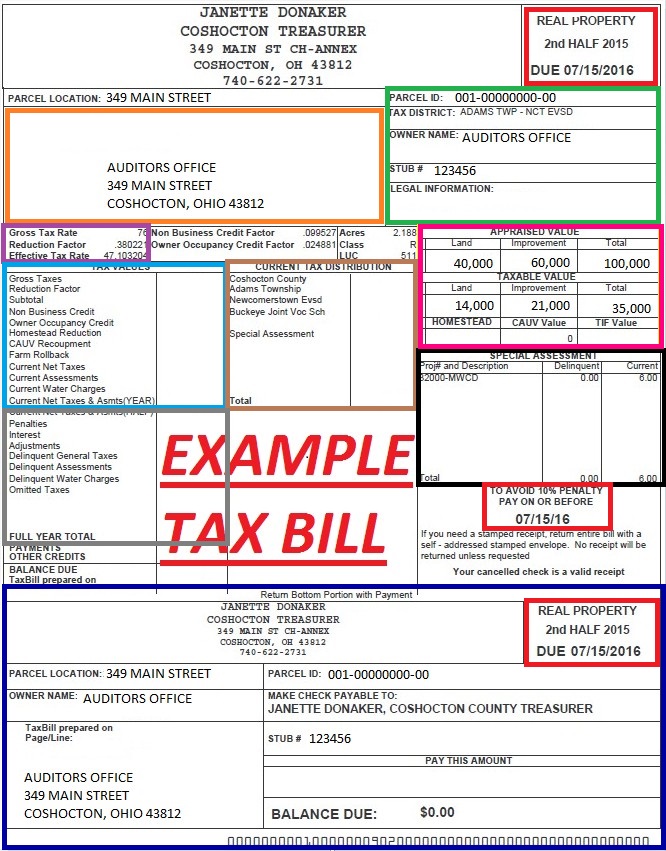

Understanding Your Tax Bill Coshocton County Auditor

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

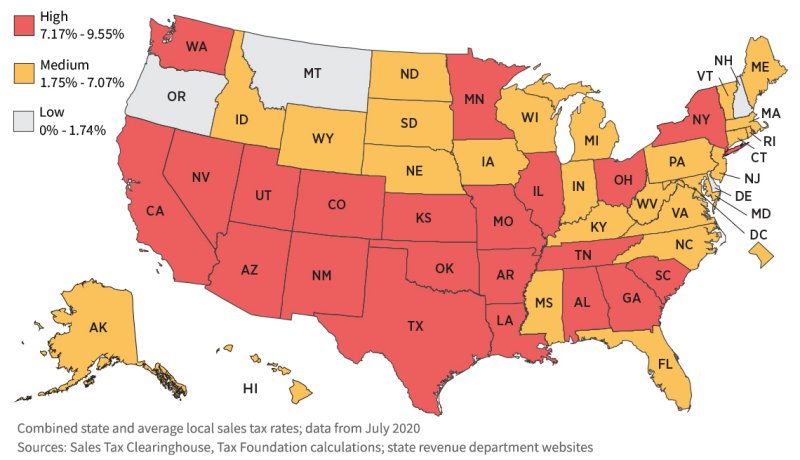

States With Highest And Lowest Sales Tax Rates

Property Taxes By State Embrace Higher Property Taxes

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com